Update on College Debt for Black Graduates

|

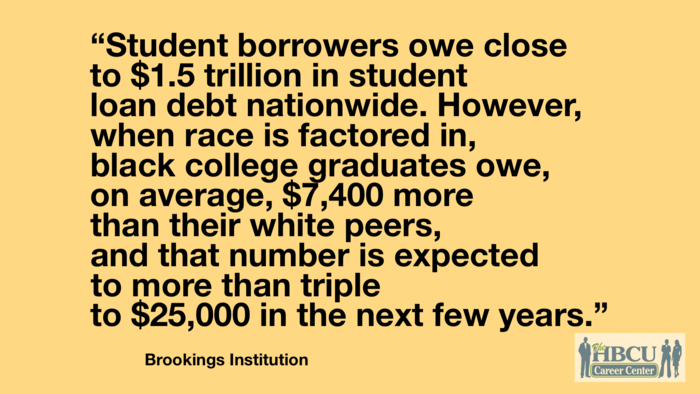

Posted By: Dr. Marcia Robinson on June 16, 2019 Both Senator Kamala Harris and Elizabeth Warren are making bold statements about investments in HBCU’s and the student debt burden on black college graduates. Senator Harris, a graduate of Howard University, is proposing to cap student debt interest payment at 3.5% while Senator Warren is proposing a $50 billion investment into institutions designated as Historically Black Colleges and Universities (HBCU). Although college debt is high across the board, graduates who are Black and Hispanic, have disproportionately higher debt. The following is a list of the statistics driving the attention on college debt for black graduates from various sources. Additionally, there are some resources to learn more and think strategically about how to manage the college debt. Debt for Black Graduates 1) 86.8% of black students borrow federal student loans to attend 4-year public colleges, as opposed to 59.9% of white students. (Source – National Center for Education Statistics (NCES)) 2) Americans (4 million of them) owe over $1.48 trillion in student loan debts. (Source – National Center for Education Statistics (NCES)) 3) Black students borrow federal student loans at higher rates than other groups of students. (Source – National Center for Education Statistics (NCES)) 4) An estimated 77.7% of black students borrow federal student loans to pay for a higher education. This figure is significantly higher than the national average for all students (60%) and for white students (57.5%). (Source – National Center for Education Statistics (NCES)) 5) Among black students who started school in 2003, 50% defaulted on student loans within the following 12 years. For Hispanics it was 36.1% and whites it was 21.5% of students. (Source – National Center for Education Statistics (NCES)) 6) When race is factored in, black college graduates owe — on average — $7,400 more than their white peers, and that number is expected to more than triple to $25,000 in the next few years. (Source: Brookings Institute) 7) A 2016 also found that a higher percentage of students at HBCUs — 80 percent — used federal loans to pay for college compared to 55 percent of students not attending an HBCU. (Source: United Negro College Fund (UNCF) report) 8) It also found that a higher percentage of students — 12 percent — at HBCUs combine federal, state and private loans to finance their education, compared to 8 percent of non-HBCU students. (Source: United Negro College Fund (UNCF) report) Managing Debt for Graduates The team at U.S. News & World Report recently created a series guide that breakdowns the different types of student loans and available repayment options, how they work and what students should know before considering them. They have shared the research with us and we are sharing those links here to help you manage your student loan debt! Start thinking about how to manage your private student loans and loan consolidation. It’s not too early! (Find links in the blog at TheHBCUCareerCenter.com) If you enjoyed this article, Join HBCU CONNECT today for similar content and opportunities via email! |

Comments

More From This Author

Latest Blogs

|

Billboard Charting R&B Artist DIAMONIQUE JACKSON Releases Sultry New Single "I Deserve More"@DIAMONIQUEJACKSON

#DIAMONIQUEJACKSON

New Video "I Deserve More" Below!

https://youtu.be/LjeJ-j4-Oso?si=1ukQoUkYOu...

BILLBOARD-CHARTING R&B ARTIST DIAMONIQUE JACKSON ENTERS 2026 WITH A NEW ER ...more

LaMarr Blackmon • 390 Views • February 17th, 2026 |

|

The hidden risks of using Google’s Blogger platform

After reviewing a detailed Site Checker report, I discovered that many of my blog’s URLs were taking far too long to load. As a result, readers abandoned the pages before they even opened. This wasn ...more

Joel Savage • 110 Views • February 16th, 2026 |

|

BLACK OWNED BEAUTY SUPPLY ASSOCIATION (BOBSA) AND JUNIQUES AD SERVICE CREATES DFY 30 SEC DISTRIBUTION SERVICEANNOUNCEMENT

Juniques Ad Service, a proud Juniques Company, is excited to share a powerful new collaboration with the Black Owned Beauty Supply Organization. Through this collaboration, members and s ...more

rickey johnson • 170 Views • February 11th, 2026 |

|

MEDIA ALERT! USA -Call for Submissions- Gumbo for the Soul: Women of Honor with PowerMEDIA ALERT! USA

-Call for Submissions-

Gumbo for the Soul: Women of Honor with Power is currently under development by the visionary team of Gumbo for the Soul International®.

This a ...more

Beverly Johnson • 162 Views • February 10th, 2026 |

|

Keeping the Faith!!!! 10 Videos, MindMap, CheetSheet, and so much more to discuss FAITH!!!!https://learners.juniquesadservice.com/courses/offers/21e32619-5774-44e2-93d9-a3df7d93a778

Welcome to the course for You!!! Keep The Faith

Video 0- Introduction

Video 1 Why Faith is So Import ...more

rickey johnson • 395 Views • February 9th, 2026 |

Popular Blogs

|

Divorce in America in 2009 – What’s love got to do, got to do with it?

Join Brother Marcus and the cast and the crew of the Brother Marcus Show live this Sunday evening on February 1, 2009 @ 8:00 p.m. for another hot topic in our community! “Divorce in America in 2009 ...more

Brother Marcus! • 70,796,980 Views • January 27th, 2009 |

|

VISINE ALERT!!!Seemingly innocent medication such as Visine eyedrops are used by people to concoct a mixture with similar effects as a date-rape drug.

When mixed with alcohol and taken orally, the eyedrops can l ...more

Siebra Muhammad • 118,266 Views • May 23rd, 2009 |

|

"Chain Hang Low" check out the real meaning of the Lyrics!Recently there is a new artist out of Saint Louis that goes by the name JIBBS. Jibbs debut single "Chain hang low" has a history that most people are not aware of. The particular nursery rhyme that th ...more

Tyhesha Judge-Fogle • 75,214 Views • November 9th, 2006 |

|

HBCU Marketplace Gifts: Divine 9 Premium Fraternity / Sorority Playing CardsVendor: Charles Jones

Item Price: $20.00

Price Includes Shipping: Yes - Shipping Included

Item Description:

Pantheon Series - Divine 9 - Premium Playing Cards (choose Gold Series or Silve ...more

How May I Help You NC • 61,555 Views • December 2nd, 2018 |